The beauty landscape has undergone a significant shift in the past few years, from lockdown looks to post-pandemic glow-ups and the rise of dupe detectives during the cost-of-living crunch. CORQ has analysed how this impacted the market, what it means for makeup vs skincare, and what’s next for creators and socials.

Influencers have embarked on an impressive journey since the onset of the Covid-19 pandemic in 2020. As conventional press conferences, launch events, and in-person brand activations stalled, creators carried on somewhat unabated and became the powerhouse of knowledge and a touchpoint for buying decisions.

But the challenges didn’t stop there – the UK has been in the midst of a cost-of-living crisis and this understandably saw a reduction in more “frivolous” purchases, such as cosmetics. As the recession continues, influencers have the opportunity to provide some light relief to their audiences but must balance this with being respectful to those tightening the purse strings.

Key takeaways:

- The pandemic caused a shift in consumer preferences as Brits favoured natural looks and skincare-first products amid an emerging work-from-home culture. Also, the cost-of-living crisis has led to a growing emphasis on trusted favourites and brands are having to work harder to build trust with consumers.

- 65% of UK businesses planned to increase their influencer marketing budgets in 2020, according to marketing insights platform Takumi. The creator economy is forecast to value $528.38 billion (£422.27 billion) by 2030.

- In 2020, the UK skincare sector generated a market volume of US $4.2 billion (£3.6 billion), while makeup recorded a market volume of US $2.3 billion (£1.9 billion). In 2023, makeup’s market volume increased to US $3.17 billion (£2.7 billion), yet skincare remained on top with a revenue of $4.48 billion (£3.8 billion), suggesting skincare remains the priority for most consumers.

- Data and analytics business Kantar’s 2022 global study revealed a 28% decrease in makeup usage compared to pre-pandemic levels, showing a renewed emphasis on skincare.

- CORQ spoke to four beauty creators about their thoughts on the market, how it has changed and how this has impacted them as influencers

- TikTok’s strength lies in its educational potential. It emerged as a leading platform for beauty education during the pandemic, providing consumers with valuable insights into the beauty world. Makeup fan Yasmin Abdullahi suggests that TikTok makes information more accessible, alleviating consumer overwhelm.

- Brand consultant Dani Nicholls told CORQ that consumers are more conservative with purchases nowadays and are instead looking to invest money in better-quality products that deliver more noticeable results.

- Beauty creator Atifa Arshad predicts TikTok Shop will continue to help brands and creators grow as consumers slowly turn their backs on retailers.

As brands grasped their intrinsic value by leveraging creators’ audiences and engagement, the global creator economy market saw exponential growth – marketing insights platform Takumi revealed that 65% of UK businesses planned to increase their influencer marketing budgets in 2020 – and was predicted to continue on an upward trajectory. According to global market intelligence company Coherent Market Insights’ data, the industry was worth US $127.65 billion (£102 billion) in 2023 and is forecast to reach US $528.39 billion (£422.27 billion) by 2030.

But drilling down a little further, how does the skincare market compare to makeup? Data gathering company Statista reported that in 2020, the skincare sector in the UK outperformed the makeup sector. Skincare generated a market volume of US $4.2 billion (£3.6 billion), while makeup recorded a market volume of US $2.3 billion (£1.9 billion). Despite growth in the makeup sector in the following years, skincare remains in the lead. In 2023, makeup’s market volume increased to US $3.17 billion (£2.7 billion), yet skincare remained on top with a revenue of US $4.48 billion (£3.8 billion), suggesting skincare remains the priority for most consumers.

CORQ spoke to four creators – brand consultant Dani Nicholls, beauty influencer Atifa Arshad, makeup enthusiast and lifestyle creator Yasmin Abdullahi, and skinfluencer Andrew Wheatcroft – about the beauty market from a creator perspective, where it has travelled in the past few years and their 2024 predictions.

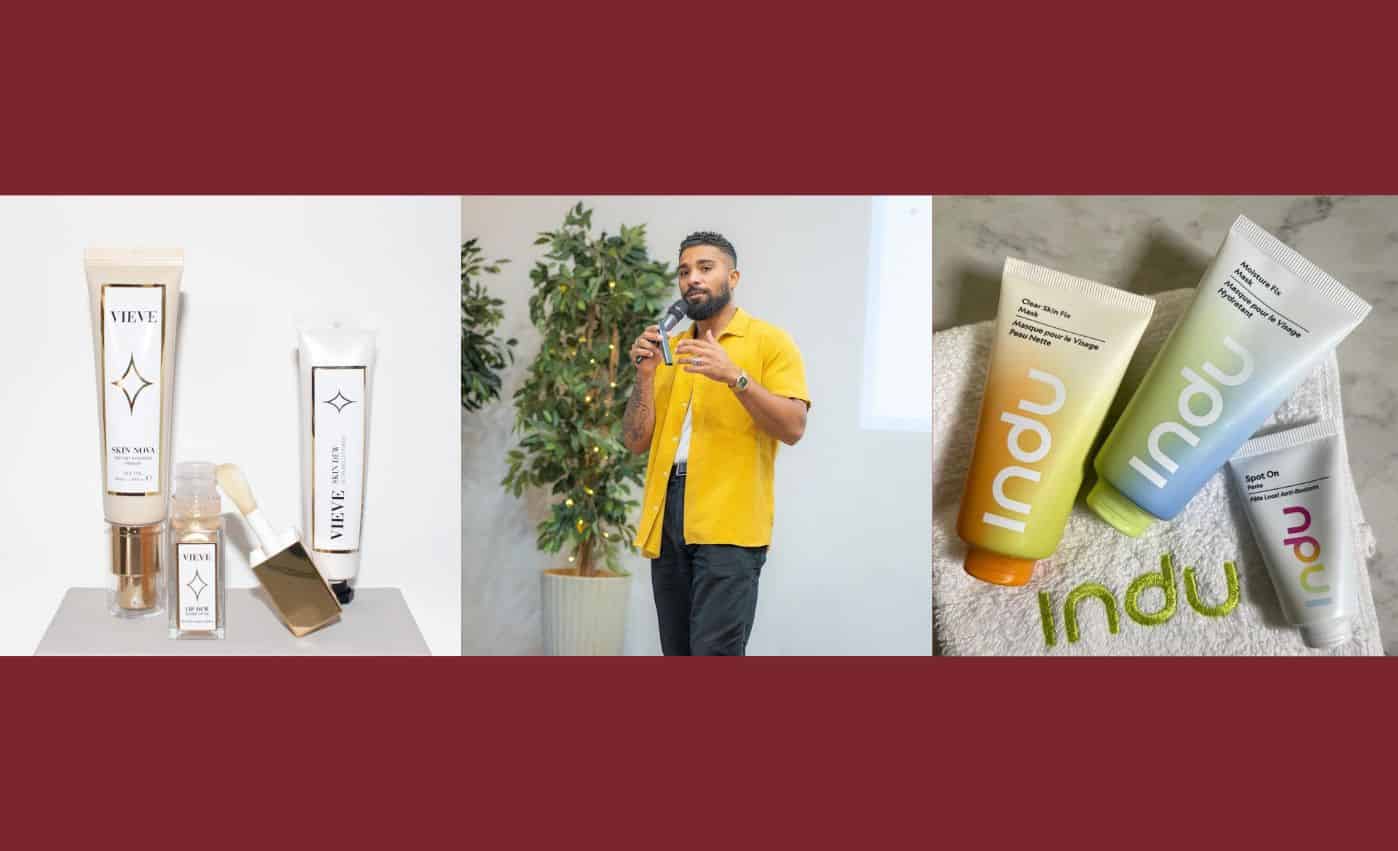

This is the first feature in a two-part series: CORQ also spoke to four industry experts – VIEVE’s CEO Emma Dawson, Gen Z market research platform Imagen Insights’ co-founder Jay Richards and teen beauty brand Indu’s co-founders Aaron Chatterley and Reena Hammer.

The rise of skincare post-pandemic

Data and analytics business Kantar’s 2022 global study, On Trend: The Evolving Beauty Consumer, revealed a 28% decrease in weekly makeup usage compared to pre-pandemic levels, showing a renewed emphasis on skincare.

This change in consumer behaviour didn’t go unnoticed by industry experts such as Wheatcroft, who observed a significant transformation in purchasing habits. Speaking to CORQ, the creator highlighted how consumers redirected their focus towards perfecting skincare routines, resulting in reduced reliance on makeup post-lockdown.

This shift isn’t solely attributed to women. Despite Wheatcroft’s audience primarily comprising women aged 25 to 54, he’s identified a growing interest in genderless cosmetics and the inclusivity of men’s beauty across social media platforms. The creator attributes this trend to better education and a desire to learn.

Wheatcroft’s approach to content creation aligns with this evolving landscape – his bitesize beauty videos garner significant attention. For example, a recent sponsored post with Garnier, breaking down the benefits of its UV Invisible SPF 50+, has had more than 5.6 million views, showcasing the effectiveness of concise, informative content in engaging audiences.

Meanwhile, Nicholls also noticed a significant rise in skincare curiosity during the pandemic: “From stress-related breakouts to limited access to professional treatments, people began researching how to better care for their skin at home.” The creator said skincare brands responded to this demand by releasing more products while makeup brands invested in multi-purpose formulas. Both sectors invested in educational content, which aligns with consumers’ growing curiosity.

Nicholls still thinks there is a “huge appetite” for makeup but “not in the same way we used to shop and hoard it” – think 2016 YouTube makeup guru era. Instead, the creator says consumers are more interested in makeup products that will help their skin health and create a “desired look”.

Despite the evolving landscape, Arshad continues to excel with her makeup content and she has built a loyal audience – she gained more than 10,000 followers in her first six months of content creation. However, her shaving tutorials and hormonal acne discussions also garner significant views. She often partners with ELEMIS, recently sharing a sponsored post demonstrating shaving with its products, which received 300,000 views. Arshad believes her followers enjoy these videos for educational purposes as well as a form of escapism.

You may also like

How social media changed the beauty landscape

TikTok’s strength lies in its educational potential. It emerged as a leading platform for beauty education during the pandemic, providing consumers with valuable insights into the beauty world. As a result, the app saw 315 million downloads during the first quarter of 2020 alone.

Abdullahi suggests that TikTok makes information more accessible, alleviating consumer overwhelm by allowing them to research products on social media before making purchasing decisions.

Nicholls agrees and says: “TikTok has allowed review-sharing culture to drive consumer purchasing habits, especially with skincare products. You’re quickly able to see what someone thinks of a product, how they add it into their skincare routine and if they saw results.” Because of this, 35.5% of 18- to 34-year-old beauty consumers in the UK shopped for products on social media in the past 12 months.

While the creator admits this has always been present on YouTube and will continue to live there, the “searchability, quick format and algorithm” of TikTok has been revolutionary. She explains that beauty creators don’t need to be journalists or have celebrity status to create meaningful and viral content – the algorithm doesn’t care for that status, and consumers prefer TikTokers’ authenticity and relatability.

Arguably, the pandemic gave influencers an upper hand, by providing them with more time to focus on content creation – and viewers with more time to consume it. Nicholls confessed that she may not have downloaded the app otherwise – prior work commitments made it challenging for her to consistently engage online.

While TikTok’s rapid-paced environment and strong user base has created a powerhouse for beauty trends, it is also a hotbed for fake news, misinformation and unrealistic beauty standards. Wheatcroft highlights concerns about TikTok promoting trends to the masses that can be harmful. As a result, the creator thinks beauty companies should prioritise Instagram if they want to be “taken seriously”.

Is the beauty industry still recession-proof?

Following the pandemic, the UK was soon confronted with a severe cost-of-living crisis. As a result, consumer spending took a nosedive, yet beauty content continues to dominate socials.

Nicholls told CORQ that consumers are more conservative with purchases nowadays and are instead looking to invest money in better-quality products that deliver more noticeable results. Her followers often request in-depth reviews and want to know which products are worth their price tag.

eMarketer’s UK Beauty 2023 report also indicates that UK shoppers are hesitant to “trade down” in beauty. The research found that 46% of adults would choose to purchase fewer skincare and makeup items in order to save money, rather than sacrificing their favourite products. As UK consumers streamline their beauty routines and seek cost-effective solutions, there’s a growing emphasis on trusted favourites rather than constantly chasing trends and new products.

As a result, brands are looking for ways to build trust with new and existing consumers. For example, The INKEY List launched its SuperSolutions range in 2022, including clinically proven products developed by dermatologists and priced at £22.99 or less.

This has paved the way for a “masstige beauty” era – the burgeoning middle ground where “mass” meets “prestige”. Masstige skincare brands that have successfully captured the “best of both worlds” include La Roche-Posay, The Ordinary and Byoma, which have all been praised for their transparency regarding ingredients and formulation. The key to success? Consumers appreciate products that are science-backed and dermatologist-approved.

The future of beauty

What can we expect this year and beyond? The creators share a similar outlook and predict affordability and education will dominate beauty trends while e-commerce platforms will reshape the sales landscape.

Wheatcroft plans to use his platform to spotlight budget-friendly skincare products, offering affordable alternatives to luxury. The skinfluencer will continue collaborating with high street brands to reflect his followers’ buying habits and admits that while his audience loves to “splurge” occasionally, this isn’t a priority.

Similarly, the creator’s audience responds well to his in-store filming videos, which also champion affordability. The first video of this series saw the creator discussing the Avène Cicalfate Skin Soothing Cream in Boots and Wheatcroft subsequently gained more than 19,000 followers.

Nicholls’ focus will continue to be on educating her audience through in-depth reviews on YouTube and via her Substack newsletter – she also plans to release the second season of her podcast Beauty 101. With a mission to help consumers make more educated decisions, the creator will exclusively work with brands that have a strong dermatological link and clinical claims.

Beauty remains one of the most successful communities on TikTok and Arshad predicts TikTok Shop will continue to help brands and creators grow as consumers gradually turn their backs on retailers. The transition from direct-to-consumer models to social platforms is being driven by consumer behaviours as beauty enthusiasts prioritise purposeful and meaningful products that will stand the test of time.

By Abby Oldroyd, CORQ news and features writer. Picture credit: Dani Nicholls, Yasmin Abdullahi, Andrew Wheatcroft and Atifa Arshad via Instagram